Art as an Asset Class: A Strategic View on Museums, Collectors & Investment Logic

Can art function as a hedge? Risk frameworks and collector behaviors analyzed through a strategy lens.

In the global chessboard of high-value assets, art is increasingly positioned not as decoration, but as diversification. No longer merely emotional indulgence or legacy investment, art has entered the language of balance sheets, capital preservation, and hedge strategies. Collectors—particularly ultra-high-net-worth individuals (UHNWIs), family offices, and institutional buyers—are now framing art in economic terms: volatility, liquidity, Sharpe ratios, and ROI.

This transformation begs deep analysis: Can art function as a true hedge? How do institutions like #UBS, #HSBC, and Bank of America assess its investment potential? What risk frameworks support these decisions? And how are museums—traditionally stewards of culture—responding to the financialization of art?

I. Art's Strategic Transformation: From Passion to Portfolio

Art’s value is subjective, but its market behavior is increasingly measurable. Deloitte’s 2024 Art & Finance Report estimates that $1.7 trillion of wealth is currently held in art and collectibles, with expectations to surpass $2.1 trillion by 2026. According to the #UBS Art Basel 2025 Report, the global art market reached $68.7 billion in 2024, up 4.5% year-on-year, with strong rebound in the U.S., UK, and China. The top 1% of collectors accounted for nearly 50% of total spend.

Quote from Paul Donovan, Chief Economist at UBS Global Wealth Management (2025 UBS Report):

"In periods of inflationary stress or currency risk, art becomes more than expression—it becomes economic resilience."

II. The Hedge Hypothesis: Is Art a Safe Harbor?

1. Inflation Hedge Behavior

Historical data reveals that art often correlates weakly with traditional financial markets. According to a study by #Citibank's Private Bank division, contemporary art delivered a 13.6% annualized return between 1995 and 2022, outperforming the #S&P500 in some periods of inflationary pressure (e.g., 2000-2002, 2008-2010). The key characteristic: low correlation.

The Artprice.com Artprice100® Index, which tracks blue-chip artists like #Picasso, #Basquiat, #Warhol, and #Richter, grew by 91% between 2000 and 2024. During market drawdowns (such as the 2020 COVID crash), art prices lagged but showed resilience in top-tier segments.

2. Risk Frameworks Used by Investment Banks

UBS and Bank of America integrate art into multi-asset risk dashboards using parameters like:

Volatility Index (σ): Standard deviation of repeat sales prices. For post-war art, σ ≈ 9.5% (UBS 2025).

Sharpe Ratio (risk-adjusted return): Contemporary Art = 0.41 vs. S&P 500 = 0.56 (1998–2023).

Drawdown Duration: On average, it takes 4.5 years for artworks to recover post-market downturn (BofA Insights 2024).

HSBC’s 2024 "Alternative Assets Briefing" explicitly notes:

“Art offers counter-cyclical buffering when paired with gold and real estate—ideal for portfolio hedging with a long-term horizon of 7–10 years.”

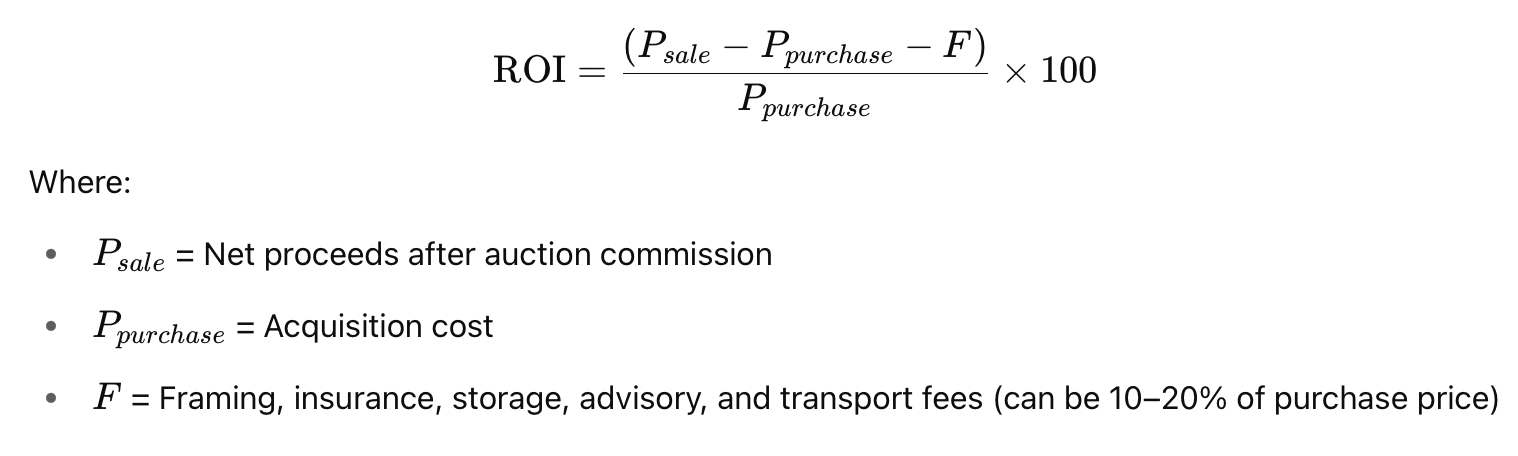

III. ROI Calculation: How Investment Banks Assess Art

Let’s break down ROI the way institutional advisors do, using UBS and Bank of America’s frameworks.

A. Basic ROI Formula Used in Art Investment

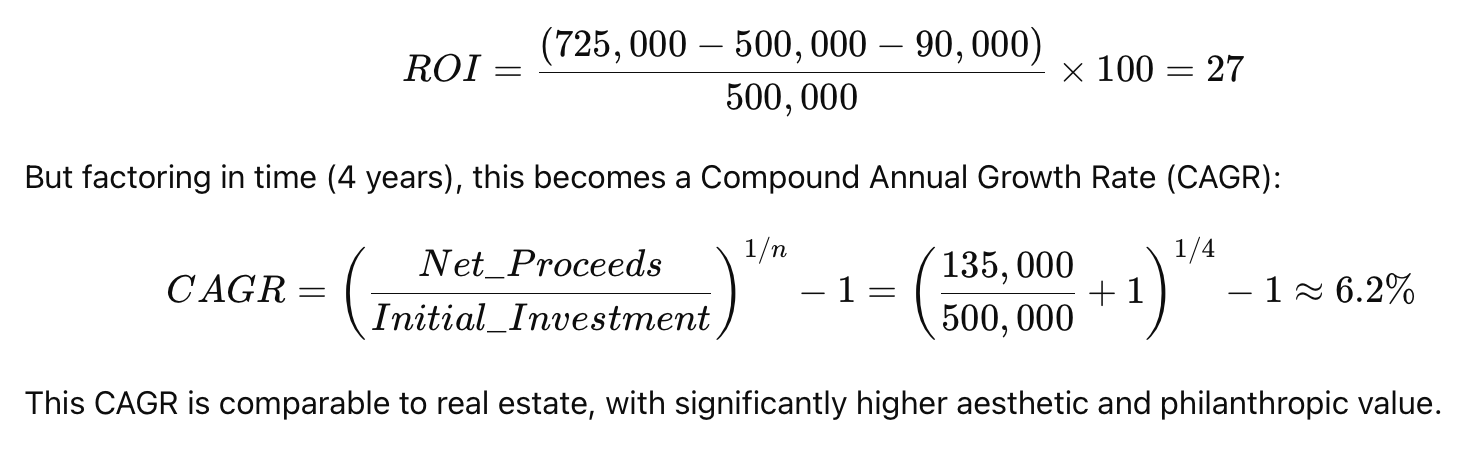

B. Case Study: Mid-Tier Collector via UBS Art Advisory (2024)

Purchase Price: $500,000 (2020)

Sale Price: $725,000 (2024)

Fees: $90,000

ROI:

IV. Quotes from Bank Art Advisors

Mary Rozell, Global Head of UBS Art Collection: “Collectors today think like CIOs. They are focused on provenance, condition, and market momentum. Art is no longer just an heirloom—it’s a liquidity tool, a currency of influence.”

Daphne King, Art & Collectibles Advisory, HSBC Private Wealth, HSBC Private Bank: “We segment art into core (museum-grade), tactical (emerging blue-chip), and speculative (new media) categories. Each carries a distinct ROI and risk profile, much like bonds, equities, and crypto.”

Christine Bourron, CEO of Pi-eX (partnered with BofA in 2024): “Auction-backed derivatives and fractional ownership are reshaping how clients view art’s liquidity. Data-driven art investing is no longer fringe—it’s a boardroom conversation.”

V. Museums as Strategic Hubs, Not Just Shrines

Museums, while traditionally nonprofit custodians, are increasingly aware of their role in validating market value. Institutional acquisition or exhibition acts as a “value multiplier,” often increasing an artist’s market price by 25–100% over 12–18 months.

Case Study: Tate Modern & Lynette Yiadom-Boakye

Following the Tate’s 2020 retrospective, Yiadom-Boakye’s works sold at Phillips and Christie’s saw a 300% increase in price ceilings. A painting auctioned at $380,000 in 2019 sold for $1.2 million in 2022.

Museums now engage in:

Art-loan collateralization programs (e.g., Guggenheim New York museum in partnership with Athena Art Finance Corp.)

Revenue-sharing exhibitions with commercial galleries

Deaccessioning strategies—controversial but effective—for raising capital (e.g., Baltimore Museum of Art's 2021 sales)

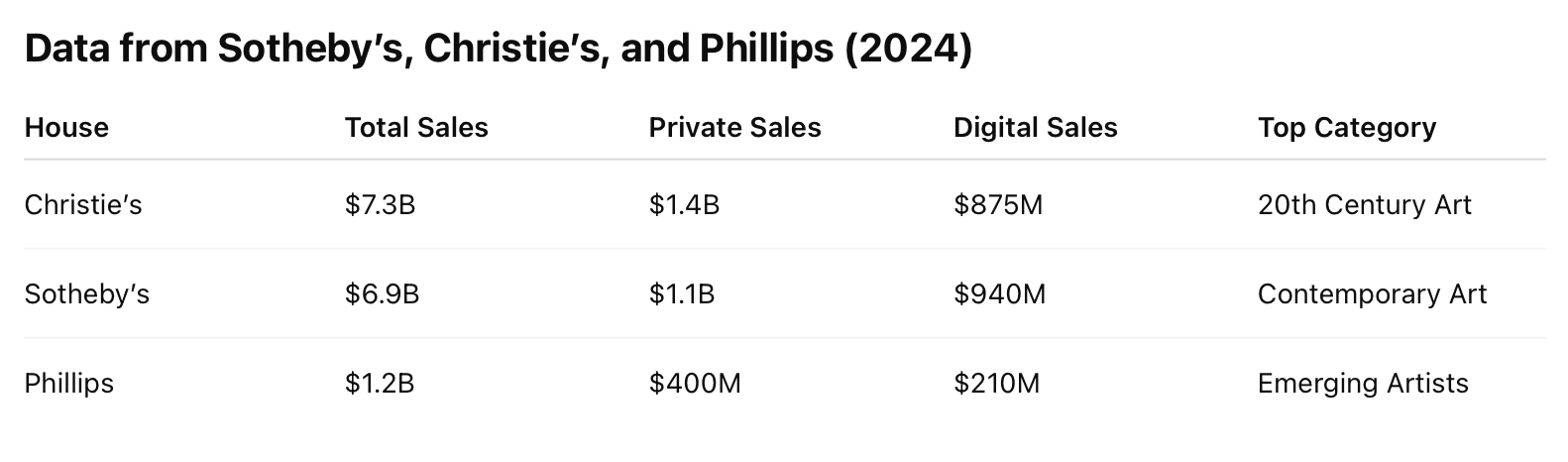

VI. Auction Houses as Market Thermometers

Phillips's hybrid online models and Christie's Web3 NFT auctions signal growing appetite for liquidity mechanisms. Fractional sales and blockchain provenance (e.g., Sotheby’s #Metaverse platform) further align art with financial asset protocols.

VII. Collector Behavior & Risk Appetite

UBS Art Basel 2025 survey insights:

68% of collectors over $10M net worth see art as a “wealth preservation tool”

45% of millennial collectors purchase with intent to resell within 5 years

53% factor climate control and shipping risk into purchase decisions

31% are active in digital or NFT-linked art markets

Quote from UBS Collector Insights (2025):

“There’s a clear bifurcation: strategic collectors who use art like a private equity play—and emotional collectors who later discover they’ve bought into a goldmine.”

VIII. Recommendations for Collectors and Institutions

Portfolio Allocation: No more than 5–10% of net assets in art, with diverse category exposure.

Due Diligence: Provenance, condition reports, and artist market trajectory are critical.

Insurance & Storage: Mitigate volatility not just by market shifts but physical risk.

Use Leverage Cautiously: Loans against art (LAA) are rising but bring liquidity pressure if markets dip.

Museum Collaborations: Strategic loans or donations can enhance both value and reputation.

IX. The Philosophical Paradox: Culture as Capital

While art offers calculable ROI, it still resists total financialization. Its essence defies spreadsheets. Yet in a world where the intangible often defines real power, the act of owning, displaying, or gifting art is deeply strategic.

Whether functioning as an economic hedge, social signal, or cultural asset, art’s multifaceted value continues to grow. And with institutional support, technological evolution, and collector sophistication, art is no longer an alternative investment—it’s an essential one.

X. Conclusion: Art Beyond the Canvas—A Strategy of Endurance

As banks deploy quant models and museums issue taxonomies of taste, art remains what it has always been—a mirror of civilization and a map of human aspiration. But now, it’s also a barometer of financial foresight.

To own art today is to participate in a narrative beyond volatility. It’s a bet not just on artists, but on values—beauty, identity, permanence. That’s a hedge worth calculating.

Next Week: Why it matters to be present online as a creator?

About the Author:

From Boardrooms to Biennales: Dipayan Melds Two Worlds in a Singular Creative Journey

With over two decades at the forefront of digital transformation, Dipayan has advised Fortune 500s and global enterprises across Asia Pacific, EMEA, and the Americas. His consulting practice—deeply rooted in emerging technology, data, and AI—has been recognized through a U.S. patent in cognitive AI and blockchain-based identity systems.

Yet Dipayan’s vision doesn’t end in strategy rooms. For more than a decade, he has also carved out a parallel path as an internationally acclaimed abstract artist. His works—poetic, bold, and philosophical—have graced museum walls and gallery floors in New York, London, Paris, Amsterdam, Dubai, and major Indian cities. With awards from Florence and Venice, his paintings now reside in private collections across New York, London, Kolkata, and Mumbai.

Residing in Mumbai, Dipayan continues to bridge two seemingly disparate worlds—technology and art—offering a rare synthesis of logic and lyricism, strategy and soul.