NFTs and the Rise of Digital Collectibles

From Crypto Curiosities to Art Market Powerhouses

In less than a decade, NFTs have transitioned from niche blockchain novelties to powerful disruptors of the global art and collectibles market. Their roots trace back to 2014 when artist Kevin McCoy created Quantum, often hailed as the first NFT artwork. However, it was 2017’s CryptoPunks and CryptoKitties that captured public imagination. CryptoPunks—10,000 pixel-art avatars—have since sold for millions, while CryptoKitties clogged the Ethereum network with $12 million in trades in a single month.

Early platforms like SuperRare and KnownOrigin emerged in 2018, giving rise to “crypto art.” From $50 million in 2019, the NFT art sector ballooned to $250 million in 2020. Yet, 2021 marked the true breakout.

When Christie’s auctioned Beeple’s Everydays: The First 5000 Days for $69.3 million, the digital-only sale made Beeple the third-most expensive living artist. Traditional institutions, celebrities, and global investors jumped in. That same year, Pak’s The Merge sold for $91.8 million, while Sotheby’s fetched $11.75 million for a rare CryptoPunk.

Market Explosion: Revenue and Profit Trends (2017–2025)

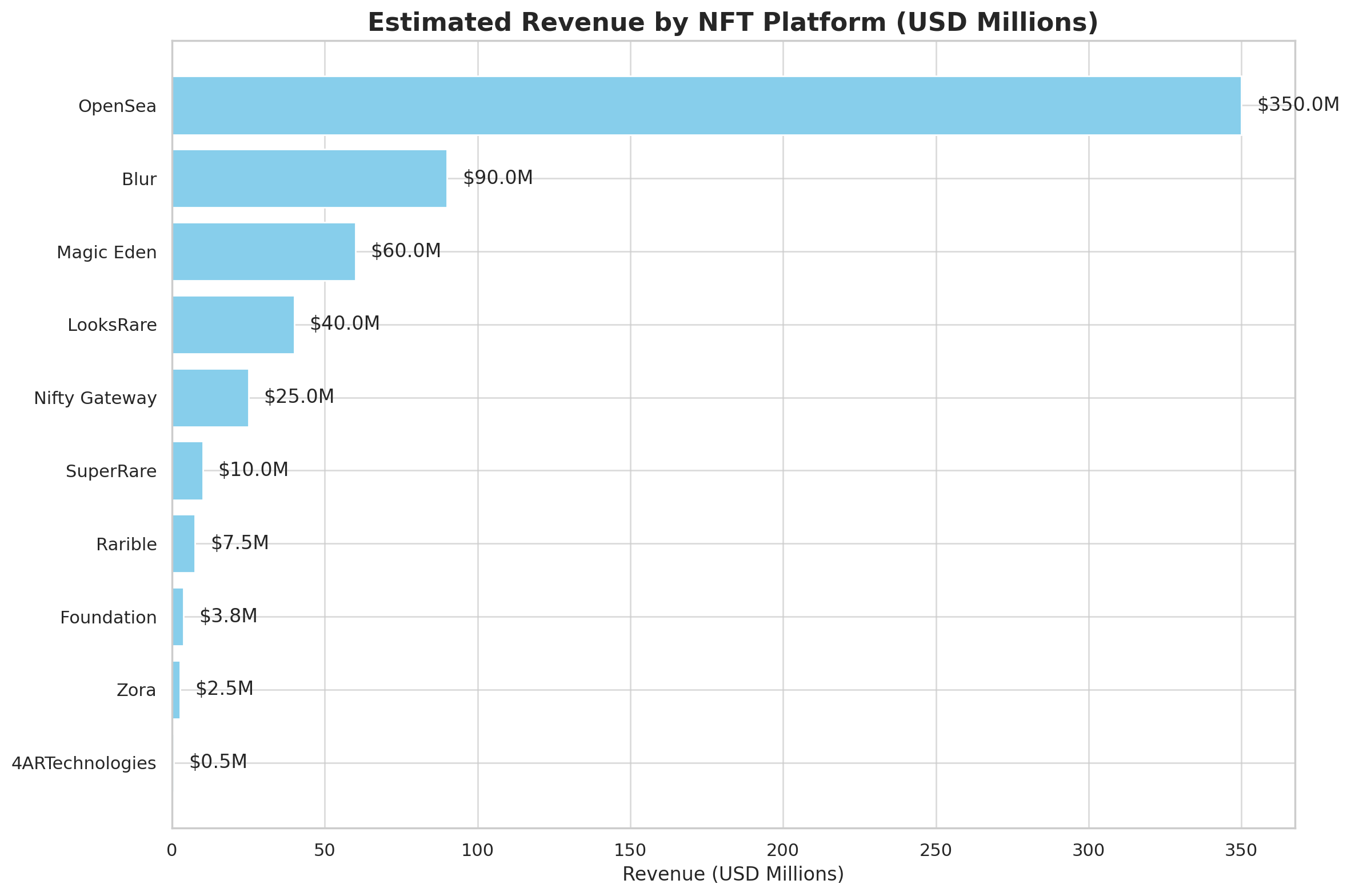

The NFT sector’s financial surge has been nothing short of phenomenal. From a modest $13 million in 2017, total NFT trading volume soared to $250 million in 2020, then exploded to $24.9 billion in 2021—a 100x leap. OpenSea alone handled over $14 billion in trades, earning hundreds of millions in platform fees.

2022 mirrored this momentum with $24.7 billion in global NFT trades. Though volumes dipped by late 2022 due to the crypto downturn, projections suggest the market could recover to $48–50 billion by 2025, with long-term forecasts estimating a $230+ billion market cap by 2030.

Artist profits have also been historic. Beeple earned over $100 million. Others like Pak, XCOPY, and FEWOCiOUS saw earnings in the tens of millions. NFTs transformed artists into financially empowered entrepreneurs, reshaping the economics of creative ownership.

The Top 10 NFT Platforms Reshaping the Ecosystem

OpenSea – The largest peer-to-peer NFT marketplace supporting Ethereum, Polygon, and more. It dominates volume with simple UX and vast collections.

Rarible – A multichain, community-governed marketplace that rewards users with $RARI tokens. Emphasizes decentralization and creator control.

Nifty Gateway – Backed by Gemini, it popularized high-value drops from artists like Beeple and Grimes. Known for credit card purchases and custodial wallets.

SuperRare – A fine-art crypto platform for 1/1 NFTs. It introduced the $RARE governance token and supports high-end curated sales.

Foundation – An invite-only marketplace known for viral art moments like the sale of the Nyan Cat NFT for ~$590K.

LooksRare – A zero-fee, rewards-based OpenSea rival offering incentives through its $LOOKS token and lower seller fees.

Zora – A protocol-based NFT platform allowing decentralized minting and marketplaces. Used for viral culture NFTs like Doge.

Magic Eden – Solana’s dominant NFT marketplace, now also Ethereum-compatible. It leads in PFPs and gaming assets.

Blur – Built for NFT traders, Blur offers analytics, bulk tools, and no trading fees. Surpassed OpenSea in daily Ethereum volume in early 2023.

4ARTechnologies (4ART) – Unique in its focus on secure authentication and provenance. Its NFT+ standard combines blockchain with forensic watermarking and augmented reality to secure physical and digital artworks.

Revenue comparison chart for different NFT platforms

Ethereum vs. Hyperledger: Infrastructure Wars

Most NFTs live on Ethereum, the original home of ERC-721 standards. It boasts the largest ecosystem, highest liquidity, and strongest network effects. Despite issues with gas fees, Ethereum’s move to proof-of-stake and layer-2 solutions have improved scalability.

By contrast, Hyperledger is a permissioned, enterprise-grade blockchain ideal for closed systems. It appeals to institutions prioritizing privacy and governance. However, it lacks Ethereum’s liquidity and standardization, making it unsuitable for public NFT markets. While Hyperledger could support back-end provenance databases for museums or private galleries, Ethereum remains the go-to chain for public-facing art and collectibles.

4ART: Leading the Future of Authentic NFTs

4ARTechnologies bridges traditional art and blockchain. Its NFT+ standard adds a legal, forensic, and visual identity layer to NFTs.

Key features include:

KYC for creators to reduce fraud.

Digital provenance via tamper-proof metadata.

Biometric fingerprinting of physical artworks using mobile-scanned microstructures.

Forensic watermarking for digital files.

Augmented Reality tools to verify art in real space.

Collectors use 4ART to scan, trade, and verify artworks with smartphone apps, combining AR, blockchain, and biometric data. This creates a transparent, immutable link between the digital and physical world—something lacking in conventional NFTs.

Ownership, Royalties, and Global Investing

NFTs revolutionize ownership. Smart contracts enable perpetual royalties (usually 5–10%), ensuring artists earn from secondary sales—previously impossible in the traditional market.

Cross-border transactions are seamless. A collector in India can buy from a New York artist instantly, with no intermediaries. This ease has drawn a new global class of investors, especially from Asia and Latin America.

Blockchain-based provenance ensures artworks have a transparent transaction history. Combined with digital certificates (as in 4ART), this significantly reduces forgery risks.

Moreover, NFTs enable fractional ownership. A Picasso, tokenized and split into 1,000 shares, can be owned collectively—democratizing investment in high-end art. Platforms and DAOs now let users co-own iconic works.

The Road Ahead

NFTs have moved past their speculative phase and are maturing into tools for global art distribution, authentication, and investment. The path forward will emphasize:

Interoperability across blockchains

Enhanced legal and forensic tools (e.g., 4ART’s NFT+)

Institutional adoption by museums, auction houses, and insurers

Creator empowerment through programmable royalties

Expanded global access to blue-chip art investments

In conclusion, NFTs and blockchain technology have propelled the art world into a new paradigm of digital ownership and global connectivity. The past few years were just the beginning – a period of experimentation, exuberance, and education. Now, with lessons learned, the industry is maturing. Artists are leveraging smart contracts for fairer compensation, collectors are enjoying a more direct and democratized market, and even traditional institutions are tiptoeing in, recognizing the staying power of this technology. While NFTs have had their boom and bust cycles, the underlying innovation – a decentralized yet trusted way to own, authenticate, and trade creative works – is here to stay. For investors, collectors, curators, and blockchain companies alike, the rise of digital collectibles is not just a trend but a fundamental shift. As we move toward 2025 and beyond, the art market’s borders will continue to dissolve, and concepts like provenance, ownership, and artistic value will be increasingly written in code on the blockchain, for the world to see. The canvas of possibilities is wide open, and the next brushstrokes in this story will be painted by a global community, collaboratively and indelibly, on-chain.

Next Week: Predictive Analytics in the Art Market: When Algorithms Meet Aesthetics

Dipayan has been a digital transformation consultant and advisor for over two decades to large multinational firms, with a keen interest in data and AI and a patent in cognitive AI and blockchain. He has worked with clients across Asia Pacific, EMEA and Americas. He is also a practising internationally acclaimed abstract artist for over a decade. His works are shown across various galleries and museums in New York, London, Paris, Amsterdam, Dubai and India, awarded in Florence and Venice, and have been included in numerous private art collections in New York, London, Kolkata and Mumbai. He lives and works out of Mumbai in India